The new Investment Charter presented by Deputy Minister Mohcine Jazouli is a complete break with the 1995 charter. The regions will find in it material to impact the attractiveness of their territories. But it remains hesitant on the incentives for VSMEs and the internationalization of Moroccan companies.

27 years after the promulgation of the 1time Investment charter, Morocco has finally decided to adopt a new charter. Expected since 2015, this delay is explained, I hope, by the time necessary to carry out a balance sheet (cost-benefits) of the application of law 18-95.

What are the contributions of the new charter? How can the regions take part in it within the framework of their own competences? and what are the aspects to be clarified through parliamentary debate?

We will attempt to answer these 3 questions briefly in view of the published version of Bill 03-22 at the end of the Council of Ministers which approved the draft framework law. Of course, other questions are up for debate and the nation’s elected representatives will certainly be able to enrich this text with their ideas and experiences.

The strategic vision of the new investment charter

The bias for the bill is clearly STRATEGIC, unlike the previous charter which was exclusively operational. The legislator wanted to position the strategic role of the state. While Law 18-95 aimed to reduce the tax burden for investment projects (Cf. art 2), Bill 03-22 sets highly more strategic objectives.

Three major strategic objectives caught my attention:

– Strengthening the attractiveness of the Kingdom with a view to establishing it as a continental and international hub for foreign direct investment;

– The encouragement of exports and the development of Moroccan companies internationally;

– The increase in the share of private, national and international investment in the total investments made.

The announcement of these objectives reflects the dynamic set in motion by the Kingdom since the beginning of the 2000s, as a country which assumes its continental ambition without complexes and the strategic role of the State in supporting Moroccan companies on international markets. It also reveals one of the challenges to be met, identified as the Achilles’ talent of our economic policy, namely the lack of private investment in the investments made.

The role of the regions

The new charter in its article 4 reinforces the role of the regions in the promotion of investments and support for businesses as provided for by the framework law 111-14 relating to the regions in its article 82.

Moreover, the fact that the support of the State and the region for investment projects can be combined (art 6) and that the actions of all the stakeholders in terms of development, promotion and attraction of investments must be exercised within a framework of coherence, convergence and complementarity (Art 5), it is in the interest of each region to define its investment attractiveness policy in order to target its priority objectives.

The “investment committee”

Contrary to framework law 18-95, which did not deal with investment governance, the bill sought to establish “a ministerial body” whose certain prerogatives are reminiscent of the investment commission.

However 3 major differences are to be emphasized

– The famous investment commission was defined in a regulatory text, in this case the decree of application of the law n° 2-00-895 of January 31, 2001.

– The said commission is called “Interministerial Investment Commission” whereas the draft law speaks of a ministerial body.

– The evaluation of public policies in terms of investment development, totally absent from the prerogatives of the investment commission, appears very explicitly in the missions of the ministerial body provided for by the bill.

declarations of intent

Another novelty in this investment charter are the declarations of intent, which create neither obligation nor rights and even less an investment incentive framework. These are articles 22 to 30 in this case. Of course, it is important to reassure investors about the availability and competitiveness of the inputs for any investment project (land, HR, financing, energy, logistics, IT) and on relations with the administration. However, citing them in specific articles is out of step with the desire to position the text at a strategic level and reminds foreign investors that we still have these weak points.

Furthermore, it is regrettable that legal certainty; which is one of the Achilles’ heels of our business environment and especially with the latest setback noted on the exequatur of arbitration awards; is not considered in this bill, even though this is a highly strategic dimension.

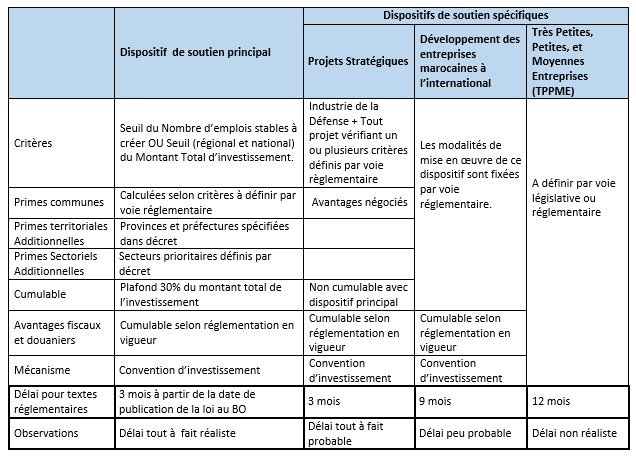

Investment incentive schemes

The intention of the legislator to integrate VSMEs as well as the development of Moroccan companies internationally in the investment charter is laudable, but postponing the definition of the incentive and support frameworks concerning them demonstrates the complexity of the subject and nevertheless risks to frustrate or disappoint the economic operators concerned.

Let us hope that the parliamentary debate can enlighten us on this hesitation.

We would love to thank the writer of this write-up for this remarkable web content

The investment charter: an incomplete revolution! – Media24

Check out our social media profiles and other pages related to themhttps://nimblespirit.com/related-pages/